- Business Growth & Optimisation

Zeller Dashboard: The Powerhouse Behind Your Business Cash Flow

The difference between a business that thrives and one that stalls often comes down to one thing: how well cash flow is managed. In this article, we explain why having a real-time reporting engine like Zeller Dashboard is key to your cash flow management strategy – and why your bank is holding you back.

The key to healthy business cash flow is twofold: monitoring and acting. Knowing where your cash is coming from and going is one thing; using that insight to guide your decisions is another. Master both, and you’ll strengthen your business’s financial health – setting yourself up for long-term success and growth.

However, keeping track of your finances can quickly become overwhelming when cash is moving through multiple bank accounts, EFTPOS systems, invoicing tools, and expense platforms. One of the smartest cash flow management strategies is to bring everything together in one place.

That’s where Zeller Dashboard comes in. By uniting your business’s financial activity in one online dashboard, it gives you detailed insights and real-time visibility that your traditional bank can’t match. From tracking sales and invoice payments to managing expenses and accruing interest, read on to discover three ways you can harness Zeller Dashboard to take control of your business cash flow.

What is Zeller Dashboard?

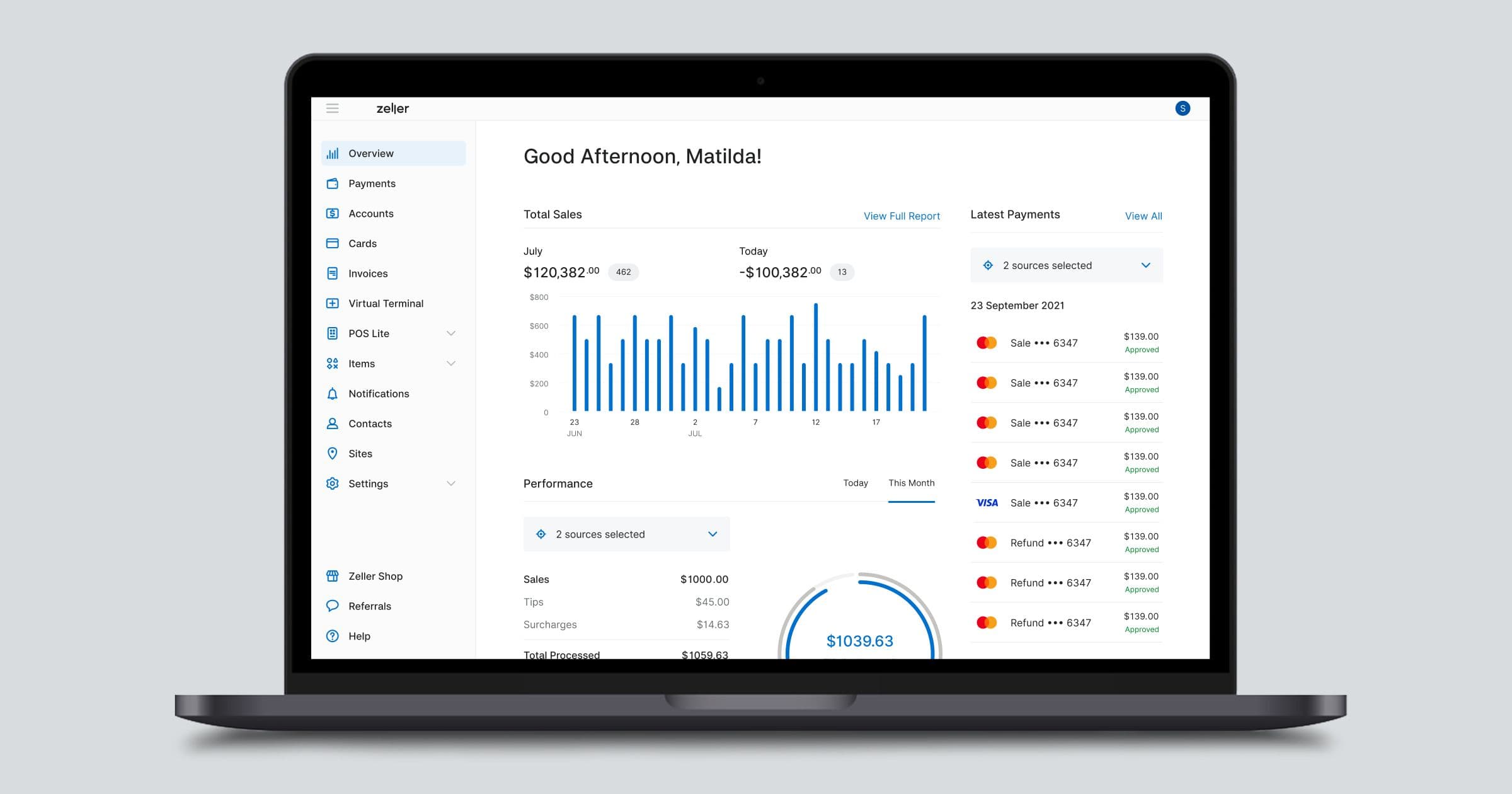

Zeller is an all-in-one financial platform that helps businesses accept payments, manage their money, and pay expenses – all from one place. At the heart of it is Zeller Dashboard: a central hub for tracking your financial position in real-time, and enabling you to use that data and insight to improve business cash flow. It transforms your financial information into clear, actionable reports and insights that help you make smarter, more informed decisions. Every way that cash flows in and out of your business is tracked on Zeller Dashboard. Read on to learn how.

1. Cash flow in: card payments, invoices, and POS

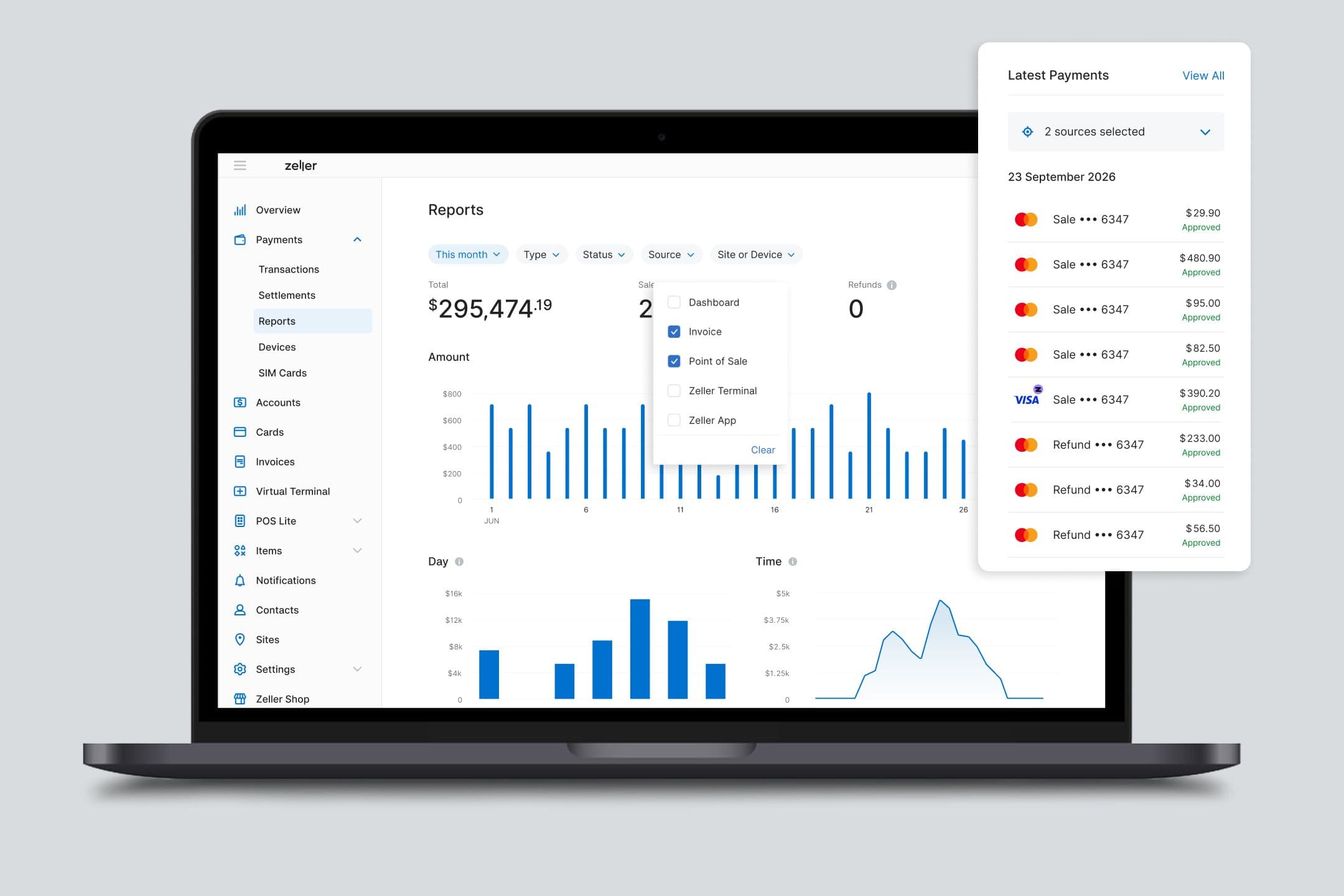

See all your incoming sales in one place – no matter how your customers pay. In Zeller Dashboard, your latest transactions are automatically compiled into a single report under the Payments tab (and in the Latest Payments preview on the Overview page). This report brings together payments from five different sources: Terminal, Point of Sale, Invoice, Dashboard, and Zeller App. Below, we’ve outlined each source and explained how to uncover specific insights for each within Zeller Dashboard.

1. Terminal

Terminal refers to any payment accepted through Zeller Terminal. If your business uses multiple terminals, you can rename each device for easy identification and more detailed tracking. For example, to find a specific transaction processed at your ‘Front Bar – St Kilda’ device, simply filter transactions by that terminal name. You can also assign terminals to specific sites, allowing you to view all payments from a particular location by filtering by Site. To filter transactions, go to Payments > Transactions, then click on the magnifying glass icon in the top right hand corner.

2. Point of Sale

Point of Sale refers to any payment processed through your POS system – whether it’s Zeller POS Lite or another POS integrated with Zeller Terminal. If you’re using Zeller POS Lite, you can view detailed insights into your sales within Zeller Dashboard by navigating to the POS Lite tab. Here, you’ll find visual reports showing your Top Items by Revenue and Top Items by Quantity Sold.

For deeper analysis, you can export a detailed sales breakdown – including the number of units sold, prices, SKUs, and categories – to create customised reports. You can also filter by specific dates and times, such as reviewing how many of one item you sold during the Christmas period last year compared to the year before, helping you forecast stock and ingredient orders more accurately.

3. Invoice

Invoice refers to any Zeller Invoice paid by card (invoices paid via bank transfer appear in the Finance tab – see below). In the Invoices tab, you can view all your invoices – paid, unpaid, or drafted – and filter them to find exactly what you need. You can also create new invoices directly from this tab, making it easy to manage your billing in one place.

To see a rolled-up or month-by-month summary of all your invoice payments, head to the Overview page and filter by Invoices. This gives you a clear snapshot of your invoicing performance and cash flow at a glance.

4. Dashboard

Dashboard payments refer to any payment received via Zeller Virtual Terminal. This feature lets you send a secure payment link directly from Zeller Dashboard via email, SMS, or any platform you choose. Your customers can then pay privately using their card details, from anywhere, at their convenience. You can find more detailed reporting about these payments under Transactions within the Payments tab.

5. Zeller App

Zeller App Payments refer to any sales made using Tap to Pay on Zeller App, an EFTPOS solution that works on Apple and Android smartphones. Like Zeller Terminal, you can name your devices for easy tracking – for example, ‘Helen’s iPhone XR’ – and assign them to specific sites, then filter transactions by device or site on the Transactions page.

Sales from the above channels are settled nightly, 365 days a year. Once settled into your Zeller Transaction Account, your balance is updated automatically on the Accounts page, as well as in the Finance tab on the Overview page. From here, your funds are ready to be used.

2. Cash flow out: debit cards and expense management

Once your funds have settled, they’re ready to pay for your business expenses. For even greater clarity on where your money is going, Zeller Dashboard lets you create unlimited accounts and cards, giving you detailed insights into your outgoing cash flow.

A smart cash flow management strategy is to set up multiple Zeller Transaction Accounts for different purposes – for example, marketing, direct costs, GST/PAYG/Super, operations, payroll, rent, or subscriptions and software. You can then link individual Zeller Debit or Corporate Cards to each account. Corporate cards are especially useful for managing team or project expenses, allowing you to set individual budgets, reset periods, and maximum transaction limits per card.

In the Accounts tab, you can view your total available balance at a glance and track all transactions, including settlements, transfers in and out, and card spending.

3. Cash accrued: growing your business savings and cash flow management strategies

By regularly monitoring the Payments and Finance tabs in Zeller Dashboard, you’ll gain a clear picture of your business’s cash inflows and outflows over time. What you do with these insights is what will make the biggest difference in improving your cash flow. Here’s how you can harness Zeller Dashboard to inform decisions that strengthen your finances:

Daily: Review transactions in real time

Whether you’re on your laptop or checking via the Zeller App, make a habit of reviewing sales and expenses throughout the day. Watch for anything that seems out of place – unusually low transaction values or unexpectedly high expenses. You know your business, so spotting outliers is often quick and easy.

“I use Zeller Dashboard a lot. It’s a great back-of-house tool and very easy to use. It surfaces information you probably wouldn’t have searched for, but once you see it, you might want to follow up.”

Adele Arkell

Radio Mexico

Once a week: Review the previous week’s sales

At the start or end of each week, compare last week’s sales in Zeller Dashboard against your goals or past results. If you’ve fallen short, act early: increase sales, cut non-essential spending, or both. This could mean ramping up marketing efforts or pausing discretionary expenses until cash flow improves.

“I'll wait until I see my cash flow for the week on Zeller App before deciding whether or not I should hold off on an order.”

Alandra Flatley

Hairdresser

Once a month: Identify trends

With a month of data, start spotting patterns – busiest days, peak trading hours, and product performance. Use these insights to optimise staffing, opening hours, and stock levels, ensuring you’re resourced where and when demand is highest. Comparing month-to-month or year-on-year data can reveal seasonal trends. For example, October is the time to prepare for the busy summer season: reviewing last year’s sales can help you know when to hire Christmas casuals or order extra stock.

"Zeller Dashboard is really handy for showing when transactions are happening. If they vary at certain times of day, it shows we need fewer or more people, so we use it to help with rostering.”

Malcolm McCullough

Bill's Farm

Ongoing: Build a cash reserve

Once you know roughly how much surplus cash you generate each week – profits not needed for immediate spending – consider scheduling automatic transfers to Zeller Savings Account, where these funds can earn up to 4% p.a. interest. A cash reserve is essential for covering late payments, rising overheads, overstocked inventory, or seasonal fluctuations. It also provides a safety net for unforeseen expenses, like equipment breakdowns, legal costs, sudden operational increases, or economic downturns.

"We use the Zeller Savings Account because it gives a much higher interest rate than the big four. Plus, there are no fees or hoops to jump through. If the money’s in the account, it’s earning interest. Simple.”

Jake Nolan

Woolcott St. Tailors

Ready to get started with Zeller Dashboard?

Take payments, manage expenses, save and organise your funds, all from one simple online dashboard. Just like a business bank, but better.