- Banking

How Zeller Gives You More Than a Traditional Business Bank Account

Running a business is all about cash flow — how quickly you get paid, how swiftly you can access your money, and how easy it is to manage your finances. A traditional business bank account often falls short on all three.

Especially when it comes to settling payments from customers. With a Zeller Transaction Account, your business gets a faster, smarter, and more flexible way to accept payments, access funds, and manage everyday finances. This article explains how.

Faster and simpler access to your money

One of the biggest frustrations for business owners is waiting days for funds from card payments to become available. Traditional banks and payment processors typically run settlement processes in batches, with multiple checks to reduce fraud — and this can delay access to your takings for up to several business days.

With Zeller, funds from transactions accepted via Zeller Terminal (or other Zeller payment methods) are automatically settled nightly into your Zeller Transaction Account — and are available to spend as soon as the next day. This means you don’t have to wait multiple days just to access the money your business has already earned.

If you prefer, you can also direct your settlements to a third-party bank account by adding your external BSB and account number in the Zeller Dashboard. Once set up, these transfers typically complete by the next business day.

We urgently needed a business bank account, but Commbank made the process so difficult. With Zeller, everything was incredibly easy — we had our account and EFTPOS machine set up right away.

Monica Bugno

Restaurant Owner

A transaction account designed for modern business

Beyond faster access to payments, a Zeller Transaction Account gives you features that make daily financial management easier and more intuitive:

No monthly fees, setup fees, or lock-in contracts — it’s free to open and use your transaction account.

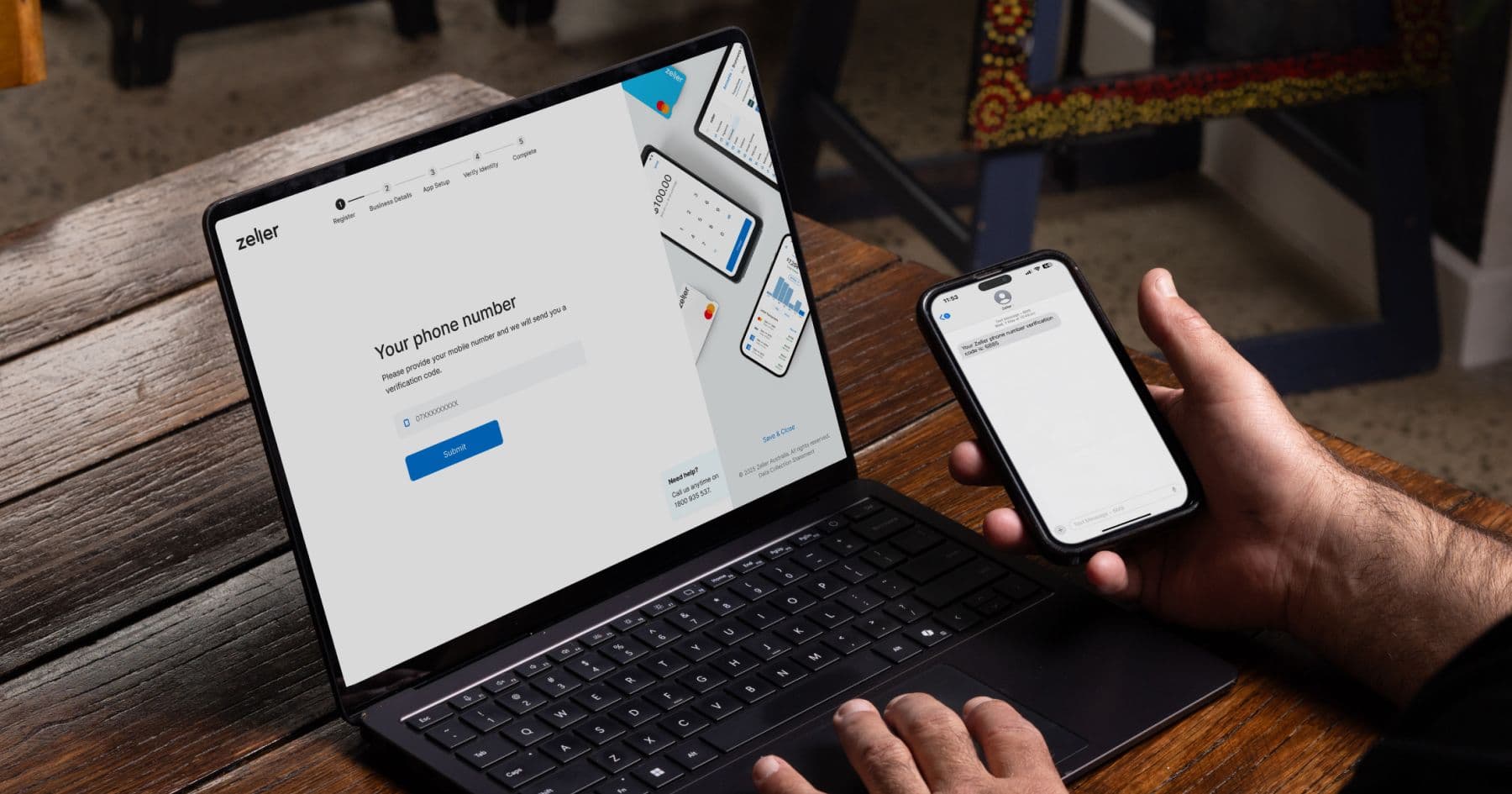

Quick online setup — open a business account in minutes without visiting a bank branch.

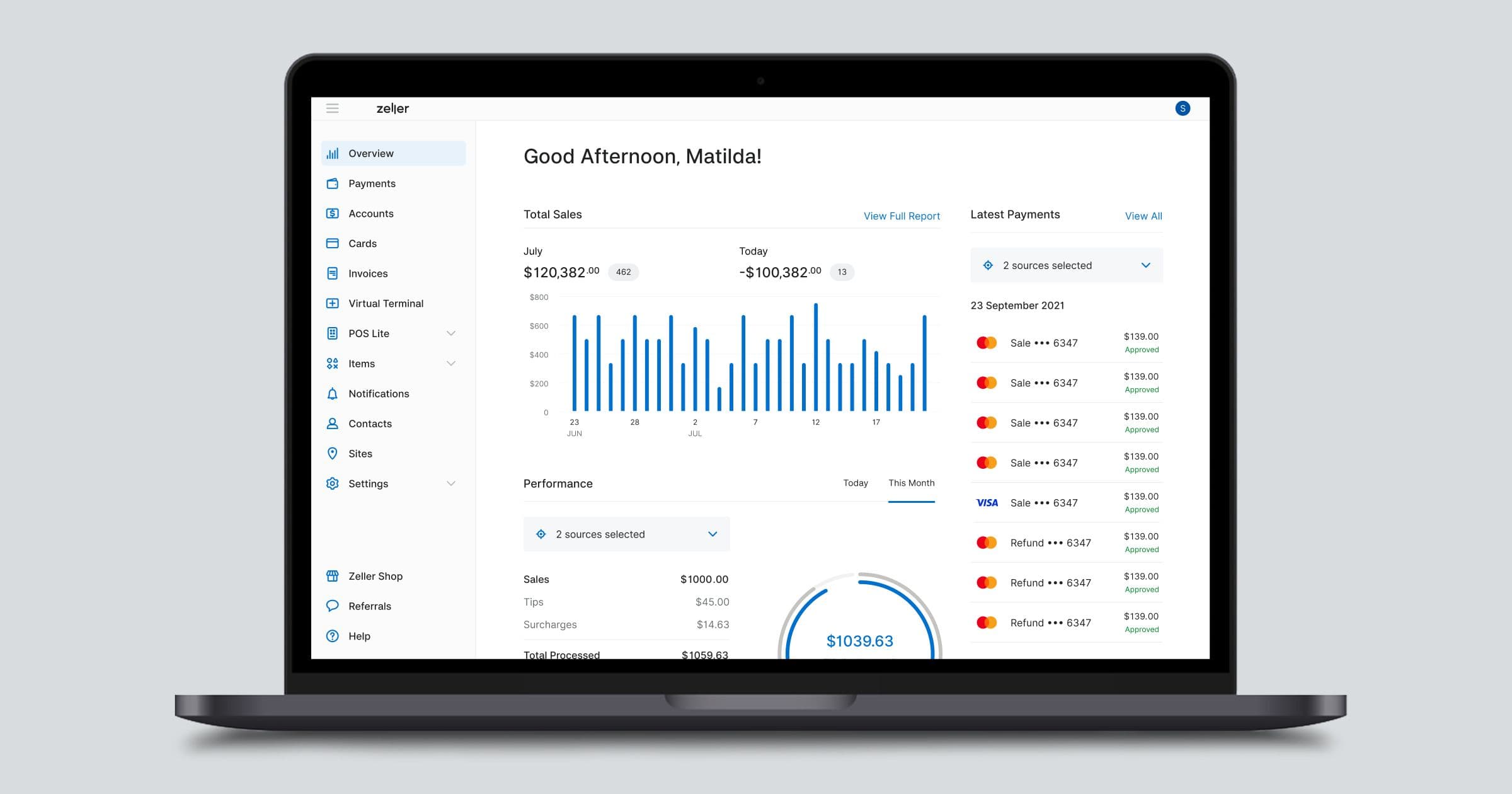

Real-time visibility into balances and transactions via the Zeller Dashboard or Zeller App, helping you stay on top of your cash flow.

Unlimited free debit cards and sub-accounts, so you can manage operating funds, savings, and expenses separately.

Easy bill payments with BPAY directly from your Zeller Account.

Attach receipts, notes and customer contacts to transactions for clearer record-keeping and simpler bookkeeping.

Zeller integrates with Xero, allowing your transactions and settlements to sync automatically into your accounting software, making reconciliation easier and reducing manual data entry.

More than just faster settlements

By combining your payment acceptance, settlement, and business banking into one platform, Zeller eliminates the delays and fragmentation that come with using separate systems. Whether you’re paying suppliers, managing staff costs, or reinvesting in your business, getting your funds sooner and having clearer visibility into your financial operations makes planning and growth simpler.

Ready to make the switch?

Say goodbye to hidden fees, lengthy paperwork, and restrictive branch opening hours. Do more for less with a Zeller Transaction Account. Sign up online in minutes.