- Banking

Zeller Contact Directory: Your Path to Better Business Relationships

Store, manage and view all your contact information in Zeller Dashboard.

Relationships play vital roles in every successful business. Regardless of whether you’re new to the world of business ownership or growing an established venture, people are at the heart of everything you do. With this latest release, Zeller now helps you to strengthen those relationships.

Zeller Contact Directory is a new contact management tool used to store business and personal details, giving you one place to see every EFTPOS payment, transaction and account transfer processed with an individual or another business. Armed with that information, you are able to better understand your business and the customers who shop with you, as well as get valuable insights about your own business spending.

Introducing Zeller Contact Directory

At its most basic, managing contact data is as simple as using an address book to maintain up-to-date information about business contacts. Yet the real benefit of having contact data on hand comes from the way you use it — to strengthen relationships with customers, suppliers and other businesses, get better oversight of where business funds are being spent, and identify opportunities to grow your bottom line.

Zeller Contact Directory enables you to understand your transactions on a deeper level, and access information about your business quicker. Smarter business decisions are made with insight.

Designed specifically for running and scaling a business, Zeller Contact Directory is a free tool for all Zeller merchants. With this release, you can now create contacts in Zeller Dashboard — making it easier to run and build your business by building more meaningful relationships with contacts who pay you, and contacts who you pay.

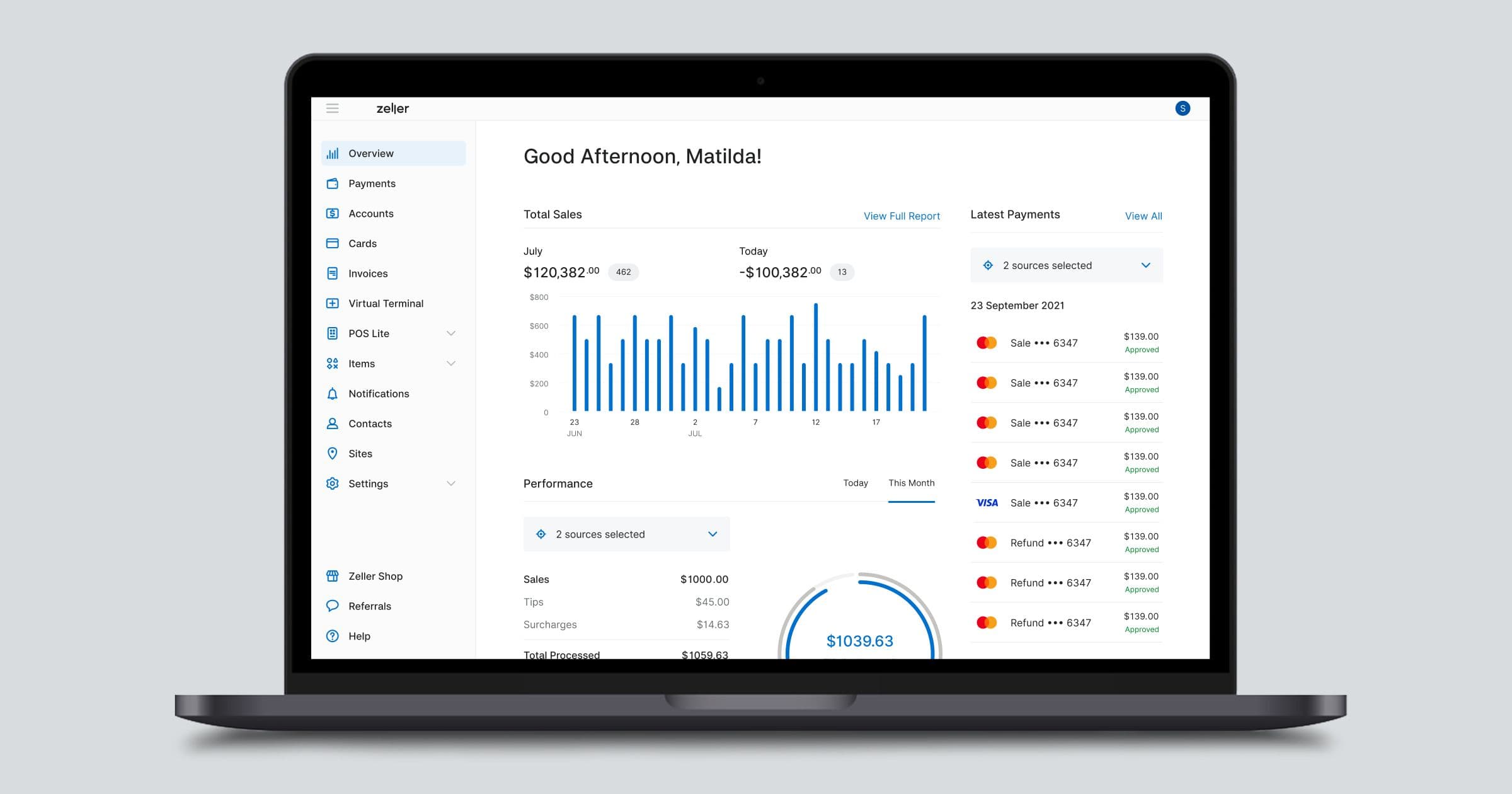

Contacts in the Zeller Dashboard.

How to get started with Zeller Contact Directory

Zeller Contact Directory is your central spot to manage all of your business relationships. With these new feature updates, there are several changes to your workflow when transferring money out of your Zeller Transaction Account, and assigning contacts to transactions and transfers.

When you need to transfer money

Transferring money is simpler by selecting a contact when processing a transfer. If your contact's details are not already populated, you can add them the next time you transfer money.Linking existing contacts to historic transactions

Search your transaction or transfer history, and then link it to an existing contact. Any existing and future transactions or transfers will now be linked to that contact.Creating a new contact in your Zeller Account

Once you've created a new Zeller Contact, you can then search your transaction or transfer history to select which transactions you want to link to that Zeller Contact.Learn more about the businesses you spend with

Business details are automatically populated for transactions spent on your Zeller Mastercard, so you can understand more about the businesses you make purchases with.

Used to its fullest, Zeller Contact Directory provides you with instant access to important information about the people and businesses you interact with.

A holistic view of every contact

Zeller Contact Directory is made up of contact records that you create. There are two types of contacts in Zeller Contact Directory: individuals, and businesses. These contacts can be linked together, providing a holistic view of the relationship web.

Each contact can be populated with a wealth of information about an individual or business you interact with, including:

general contact information, such as emails, phone numbers, and addresses

categorise contacts and add custom tags, such as ‘supplier’ or ‘book keeper’

an image, for immediate identification

account details for bank accounts you transfer money to

notes, such as details customer preferences or information about previous purchases.

New view in Zeller Dashboard

To view the contact directory, click Contacts in the left pane of Zeller Dashboard. From here, click either Add Business or Add Person and follow the prompts to create a contact.

To search Zeller Contact Directory, select the search icon and begin typing the name of the contact or tag attached to that contact. All contacts matching the search criteria will be filtered below, for easy identification.

Create and link contacts with ease

There are multiple ways to create a contact in Zeller Contact Directory. Once a contact has been created, it can then be linked to transactions or bank account details within Zeller Dashboard.

As mentioned above, a business or person can be directly added to the Zeller Contact Directory. A contact can also be created from a transaction, or transfer.

To create a new contact, or link an existing contact to a transaction, click on any past transaction in Zeller Dashboard, then select Contact and begin typing. If a contact already exists, click it to assign the transaction to the contact. If a contact does not exist, follow the prompts. All historical and future transactions using the same card will be linked to that contact. Every time a customer uses that card to buy from you, the transaction will be attached to the contact in Zeller Contact Directory.

To link details of bank accounts you regularly transfer to, open the contact in Zeller Contact Directory. Navigate to Bank Account and select Add. From here, either select an existing account or follow the prompts to create a new one. All historical and future transfers will be attached to that contact.

Relationships are the foundation of business success

Zeller Contact Directory gives you a place to store valuable information about the individuals and businesses that interact with you. Having the ability to easily surface contact information enables you to grow meaningful relationships, whether it’s by greeting a person by name or remembering details of their last purchase. Yet there are a multitude of ways that information can be put to use to strengthen business relationships.

You might want to make your repeat customers feel more welcome in store by training staff to provide a more personal customer experience, using the rich data attached to the customer’s contact record to suggest new products or services. Or you might use it to streamline the way you deal with other businesses, like your supplier. Being able to easily bring up contact details for your key supplier, including the name and direct number of your account manager as well as a list of every purchase made using business funds, makes it easy to manage things like repeat orders and better understand your spending.

Relationships are at the heart of business. The more visible information about your contacts is, the more opportunities you have to strengthen those ties. Stay tuned to discover more ways to use Zeller Contact Directory to grow your business.